Some funds are predominantly holding physical gold and the value moves up and down in sync Along with the benchmark rate. Other funds may possibly try out to imitate the benchmark cost of silver or gold employing a mixture of physical gold, options, and futures. The efficiency of those funds will, certainly, be minimized by the cost ratio in the fund and the greater active a fund’s system is, the greater it'll cost.

Quite a few retirement plans for your self-used or tiny-entrepreneurs offer you additional investment selections than most employer plans and could offer you better contribution boundaries than most employer plans and IRAs. Self-utilized folks might also be capable to build a income-sharing contribution as an employer and elective deferral — with capture-up — as the worker, rising the amount of cash put aside for retirement (although You will find a earnings-sharing cap of about twenty% of Internet gains thanks to Federal Insurance Contribution Act taxes owing on Web profits).

3. Protect your self from renters. When you've got rental home or hope to take a position in rental assets just after getting your unexpected wealth, generate a business entity for example an LLC or corporation to shield your other assets from a disgruntled tenant.

A professional distribution is made following the account has long been open for five years and you have reached the age of 59½.

Effective tax planning permits persons to reap the benefits of numerous tax rewards, deductions, and credits, which could inevitably lead to considerable savings.

The “sole” suggests it’s just you, so compared with a partnership, you don’t have to worry about a companion's actions . . . but all of your personal assets are in danger For anyone who is sued.

Once you've entered retirement, a considerable percentage of your portfolio should be in more steady, lower-possibility investments which can perhaps deliver revenue. But even in retirement, diversification is vital to helping you deal with chance. At this stage in click here to read your life, your largest possibility is outliving your assets. So just as you need to under no circumstances be a hundred% invested in shares, it's most likely a smart idea to hardly ever be 100% allotted In brief-phrase investments When you have an extended-term economical intention, which include planning to remain invested for greater than 3 decades.

37% of usa citizens who think about them selves wealthy claimed that preserving from a young age was An important Section of obtaining wealth. “We hardly ever know if the sudden will become a truth,” states Wealthy Compson, head of Wealth Options at Fidelity Investments.

A traditional individual retirement account (IRA) is a tax-deferred account. What this means is you obtain a tax split within the year any time you make contributions to it. Having said that, you'll have to pay out taxes on the money when you withdraw funds in retirement.

Gold and silver funds aren’t direct investments, on the other hand, and they generally is not going to track the precise price of physical gold. That said, they do however give investors Using the diversification of physical gold or silver with no carrying charges.

During this guideline, we’ll explore quite a few retirement plans available today, breaking down their benefits, constraints and the categories of people that may perhaps qualify for every.

The primary goal of diversification is just not To maximise returns. Its Main purpose is always to limit the impact of volatility on a portfolio.

Even though gold and silver options and futures are not restricted to just the Chicago Mercantile Exchange (CME), it is among the very long-set up exchanges and is a great place to look at the marketplace and know how the derivatives method of silver and gold operates.

Investigate much more auto personal loan resourcesBest car loans for good news and undesirable creditBest car financial loans refinance loansBest lease buyout financial loans

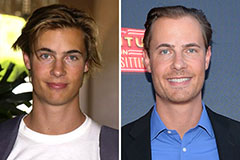

Erik von Detten Then & Now!

Erik von Detten Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!